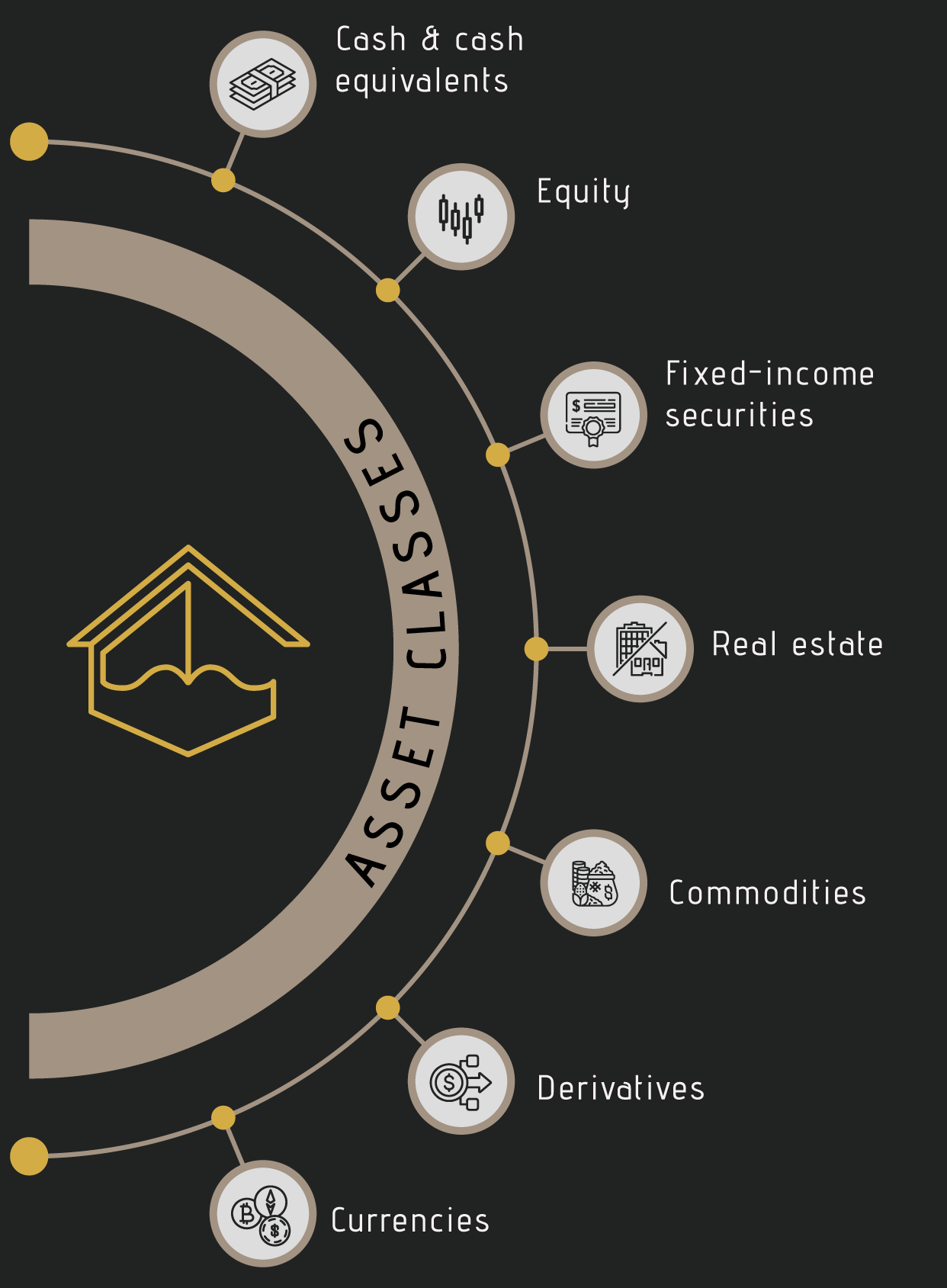

Types Of Asset Classes

What are Asset Classes?

Investments that share commonalities are grouped into asset classes. These commonalities could be level or risk, how they make money and legal framework.

Keep in mind that there is no perfect agreed list. Here is a list of 7 common categories.

- Cash & cash equivalents

- Equity

- Fixed-income securities

- Real estate

- Commodities

- Derivatives

- Currencies

Why are Asset Classes useful?

The strategy is to diversify your investments and understanding asset classes is very useful.

Some of the reasons why they are diverse-

- Within an asset class, they behave similarly.

- There is little correlation (sometimes negative) between asset classes.

- There is a difference between the levels of risk between asset classes.

The key advantage is that they allow for a move diverse portfolio.

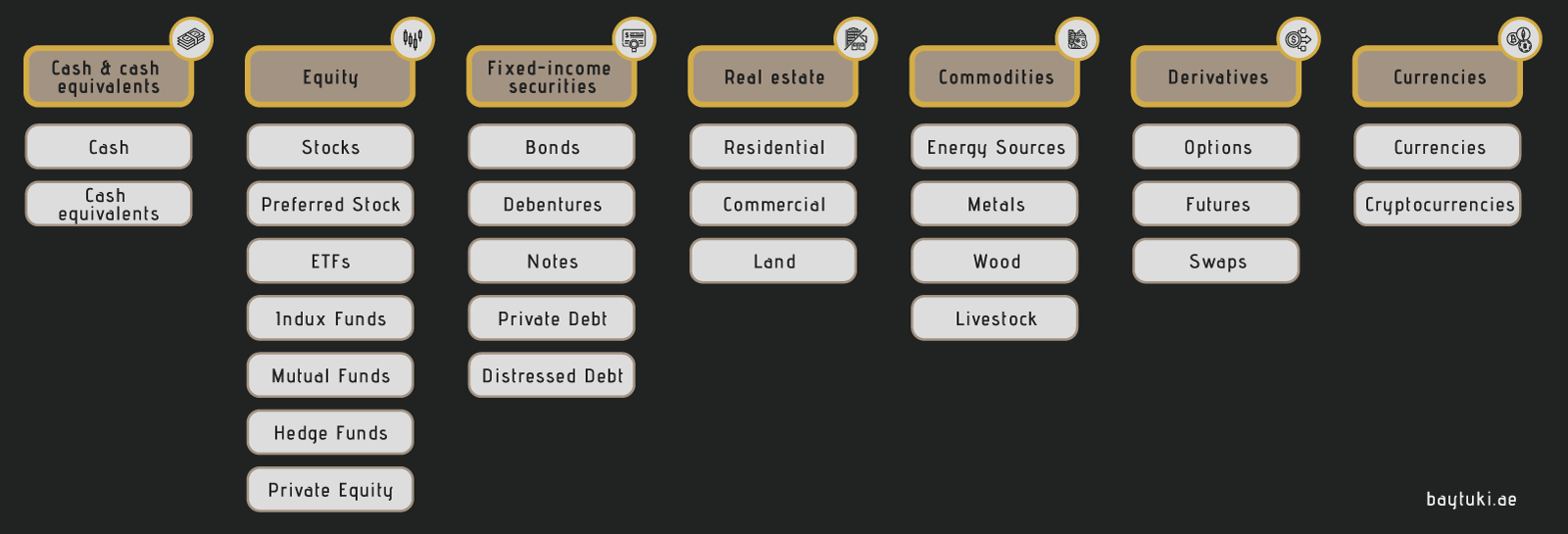

Asset Types under Asset Classes

Each asset class consists of different asset types with similar characteristics and risk profiles.

Information sourced from The Scalable Investor